A Full Inbound Strategy Built on Premium Content

In order to show customers that FSCB could keep up with the big banks on large loans, while offering the personalized guidance customers already loved, we knew we had to reach potential customers on a deeper level. That meant positioning FSCB as a home loan expert and giving potential customers the content they desperately wanted. But it also required setting up strategic workflows around that content to connect with customers at all stages of the Buyer’s Journey.

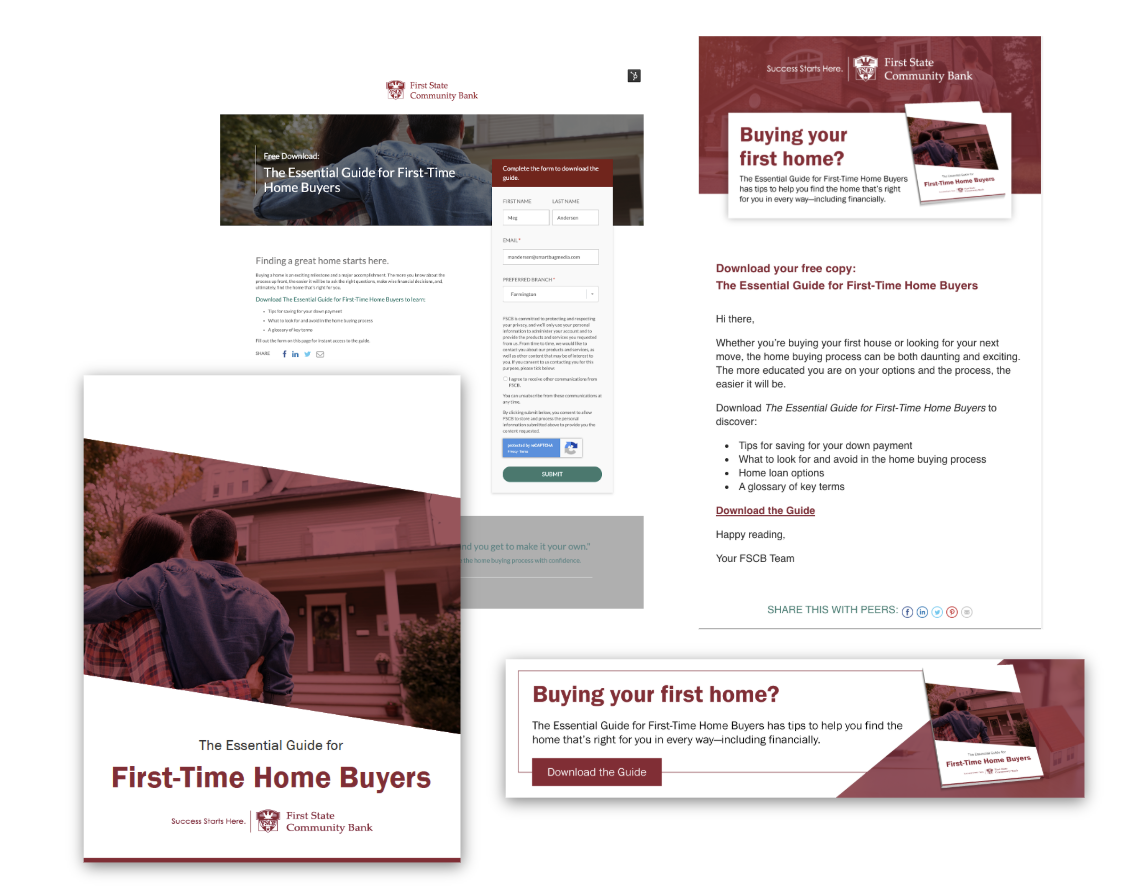

We started by creating the company’s first-ever premium content offering, “The Essential Guide for First-Time Home Buyers”. With this valuable content as a centerpiece, we pulled out all the stops, tapping into HubSpot’s Marketing Hub.

Using the premium content as an anchor, we built out a strategy to connect with, nurture, and excite potential customers. The new inbound marketing strategy included:

- Custom landing pages

- Blog CTAs

- Emails

- Social media posts

- Workflows for nurturing

- Internal workflows for branch lead routing

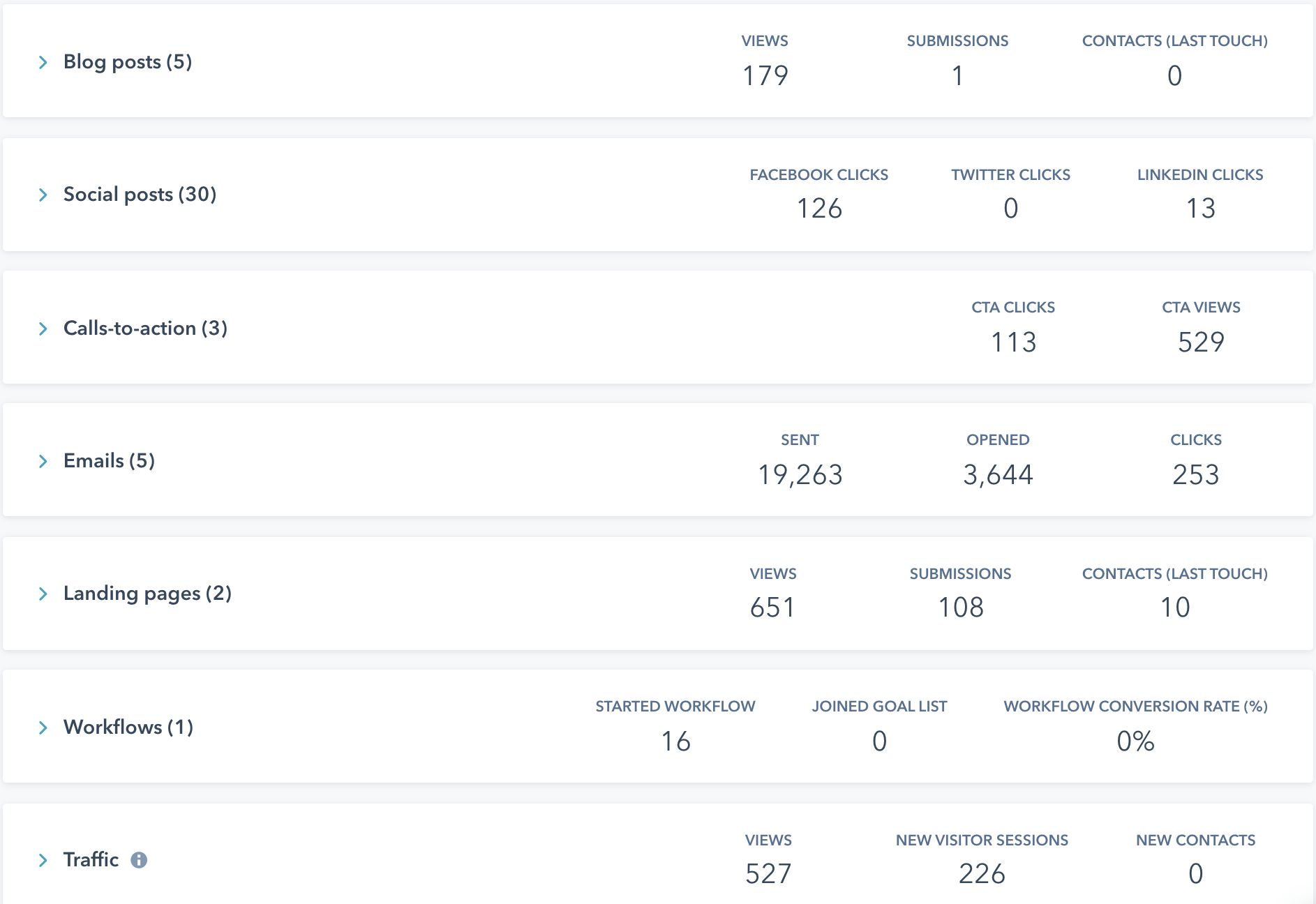

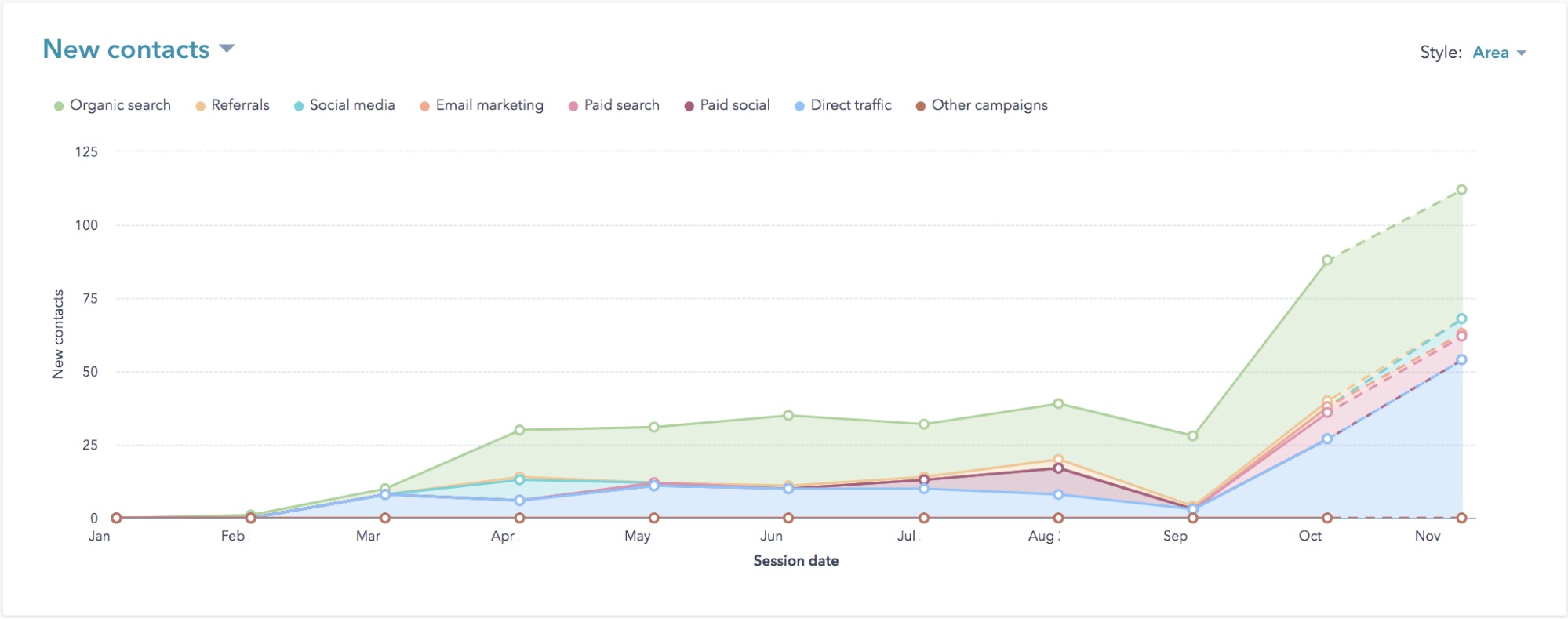

Throughout the campaign, we built out every element using HubSpot’s Marketing Hub from landing pages, blog content, social scheduling, workflows for nurturing, and internal workflows for branch lead routing and automation. All of these efforts were tied to a content-specific campaign so that FSCB could easily see performance every step of the way.

Content Creation

We knew the campaign needed to feed off of a valuable piece of premium content, so our creative and marketing teams started crafting a guide that could help walk first-time home buyers through the home-buying process. The final product gave home-buying newbies detailed answers to essential questions, including:

- How much home can I afford?

- How do I apply for a mortgage?

- How do I find a real estate agent?

- What should I look for in a home mortgage?

- What do I need to know when closing?

The full guide also featured expert advice and links to important financial tools to empower new home buyers.

Setting Up Advanced Workflows

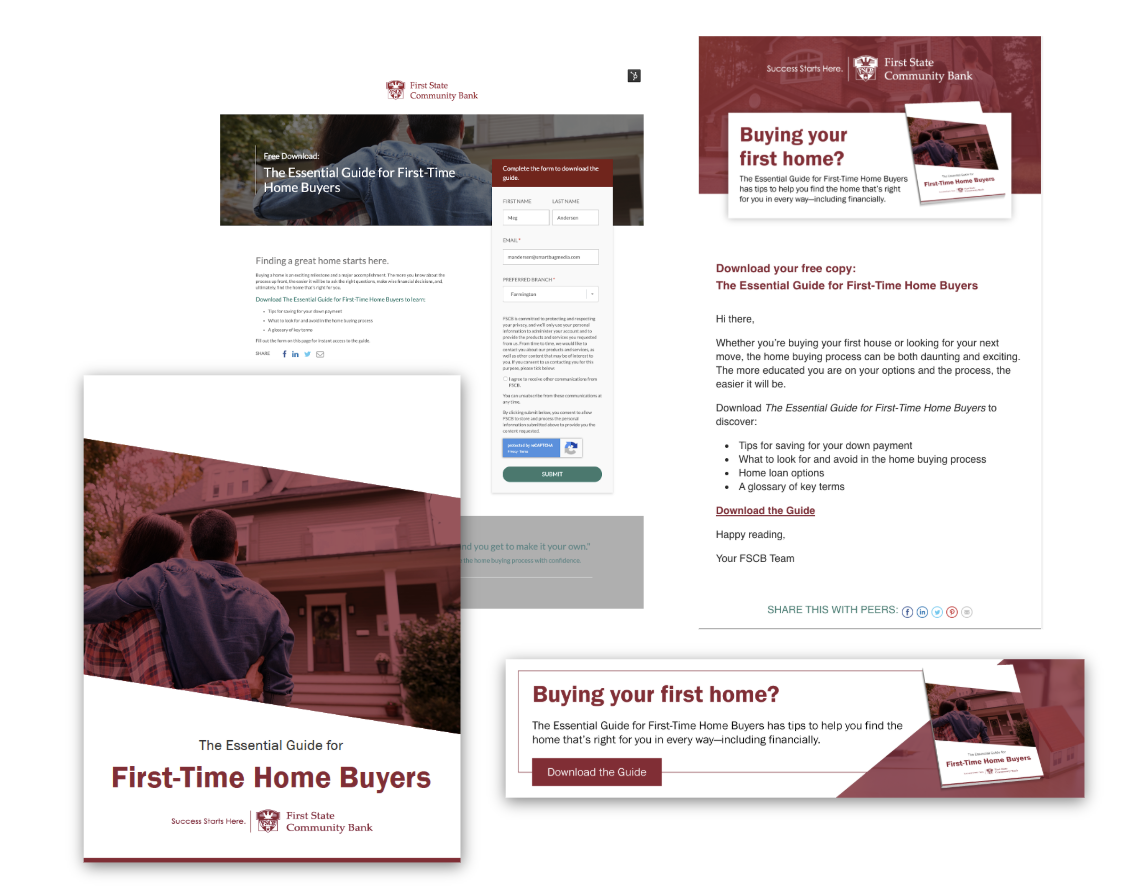

To connect the premium piece with people who needed it, our design team got to work building custom landing pages, thank you pages, and promo emails. By setting up lead forms and cutting out customer friction, the email and landing page campaign helped create conversion opportunities to help FSCB generate leads for its branches.

Designing for Action

In addition to setting up FSCB as a home loan expert among existing customers, we wanted to set up wide-open paths to reach more potential clients. What better way to get potential customers to interact with an offer than to simply ask? We built custom CTAs promoting the e-book and strategically dropped them into blogs written about related content. We also expanded reach by promoting the premium piece across social media platforms.

With these tools, we set up conversion paths to reach FSCB’s most valuable buyer personas. All paths led back to FSCB.